Steering Through Uncertainty: Practical Ways to Stabilize Your Business When Conditions Get Rough

Written by Eva Benoit www.evabenoit.com

Running a business means eventually facing periods where cash is tight, markets shift, or operations feel harder to control. For small and mid-sized business owners, these moments test not just resilience, but judgment. The way you respond during tough times often determines whether your business stalls, stabilizes, or comes back stronger.

Key Points

Stabilize cash flow before making growth decisions

Choose focus over panic when resources tighten

Use structure and planning to regain confidence

Know when to invest in skills instead of tools

Resetting the Foundation Before Chasing Solutions

When pressure hits, the instinct is often to “do more.” That instinct usually backfires. The first priority is stabilization: understanding where money is leaking, which commitments are non-negotiable, and what can be paused without long-term damage.

Before you take action, slow the pace just enough to regain visibility. That pause is not avoidance; it’s how you prevent compounding mistakes. Businesses that survive downturns rarely do so by improvisation alone—they re-anchor themselves to fundamentals.

Focusing on What Actually Moves the Needle

Once the picture is clear, focus becomes your most valuable asset. This means choosing fewer initiatives and executing them better. Chasing every possible fix spreads teams thin and drains morale.

Here are several areas worth prioritizing when resources are constrained:

Retaining existing customers who already trust your business

Protecting cash flow over vanity growth metrics

Maintaining product or service quality, even if volume drops

Communicating transparently with employees and partners

These choices may feel conservative, but they create stability that allows for smarter moves later.

Building Skills That Strengthen Decision-Making

During difficult periods, many owners realize their biggest bottleneck isn’t effort—it’s decision quality. Strengthening your business acumen can directly improve how you allocate resources, manage teams, and plan under uncertainty.

Earning a degree to deepen your understanding of business fundamentals can help you better support your company when conditions are unstable. Pursuing a business management degree can specifically help you develop leadership, operations, and project management skills that translate directly into day-to-day decisions. Many online degree programs are designed to fit around real-world responsibilities—explore accredited programs to learn more.

Practical Actions to Regain Control

When the direction is clear, execution matters more than theory. The following steps help translate intention into momentum:

Review financial statements weekly instead of monthly

Rank all expenses by necessity, not habit

Clarify one primary business objective for the next 90 days

Assign clear ownership to every critical task

Revisit assumptions about your customers’ current needs

This approach creates structure without overwhelming you with complexity.

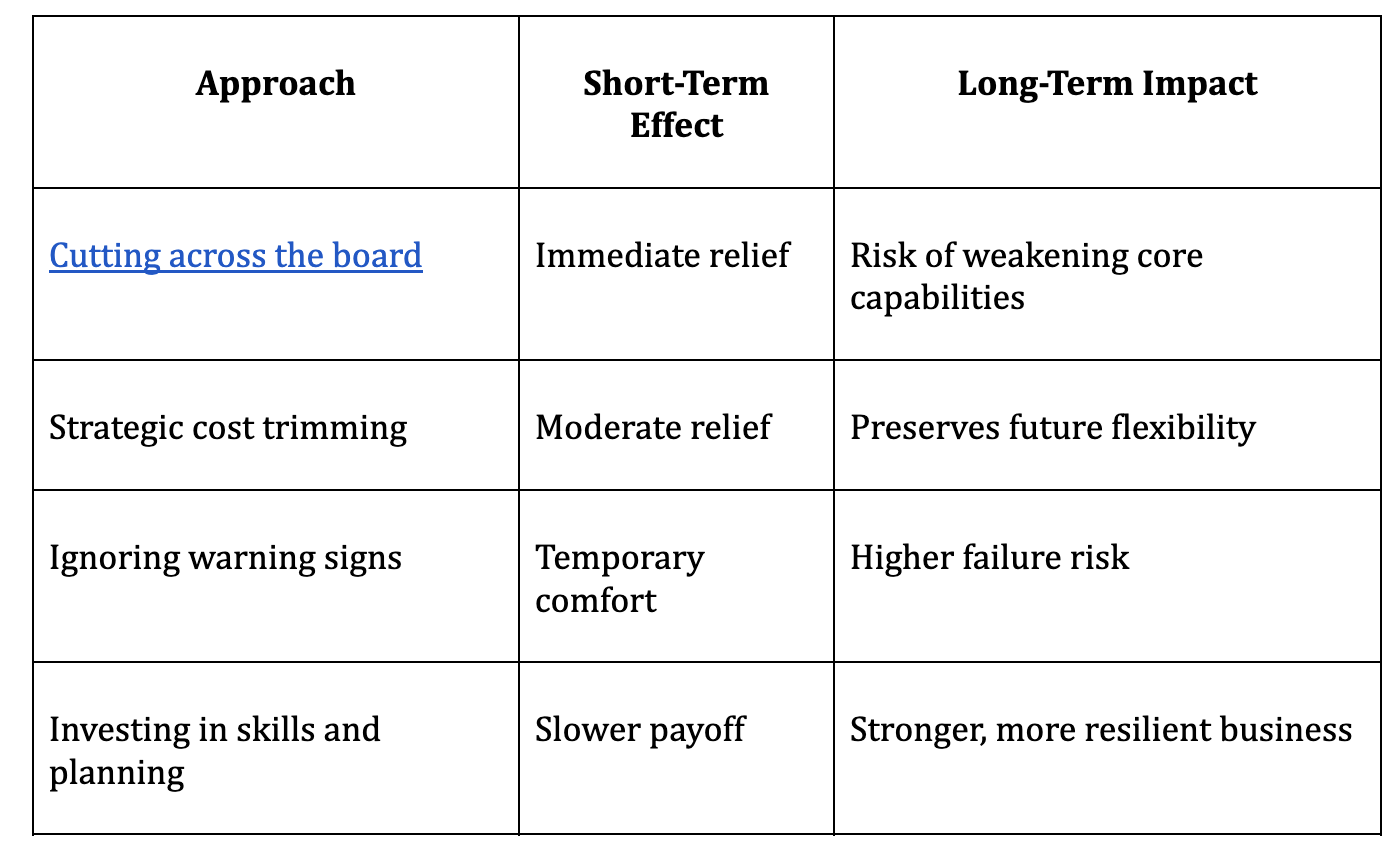

Comparing Short-Term Fixes vs Long-Term Stability

Different responses produce very different outcomes over time. Before choosing a path, it helps to compare common approaches and their implications.

FAQs for Business Owners

Before making serious changes, owners often need clarity on risk, payoff, and timing. The answers below help address those concerns.

How do I know whether my business problems are temporary or structural?

Look at trends, not isolated months. If demand, margins, or customer behavior have shifted for multiple quarters, the issue is likely structural. Temporary problems usually improve when conditions normalize, while structural ones require redesign.

Should I cut staff or try to ride out the downturn?

This depends on cash runway and future demand. If layoffs are necessary to survive, act decisively rather than delaying and draining reserves. If demand is likely to rebound, preserving your team may save rehiring costs later.

Is investing in education or training risky during tough times?

It can feel risky, but targeted education often improves decision quality. Better decisions reduce costly mistakes and improve long-term outcomes. The key is choosing learning that directly supports your current responsibilities.

How long should I give a recovery plan before changing course?

Most plans need at least 60–90 days to show meaningful signals. Set clear metrics upfront so you’re not relying on gut feel. If indicators don’t move, adjust quickly rather than doubling down blindly.

What’s the biggest mistake owners make during downturns?

Overreacting without a clear plan is the most common error. Panic-driven cuts or expansions often create more damage than the original problem. Discipline and clarity matter more than speed.

When should I consider outside help?

If you’re stuck in indecision or repeating the same conversations, it’s time. Advisors, mentors, or structured education can provide perspectives you can’t access alone. External input often shortens recovery time.

Closing Thoughts

Tough times don’t automatically end businesses—confusion and unfocused action do. By stabilizing fundamentals, narrowing your focus, and strengthening your decision-making skills, you give your company room to recover. Progress during downturns is often quiet and methodical, not dramatic. The owners who endure are usually the ones who choose clarity over chaos.